Custom Private Equity Asset Managers Can Be Fun For Everyone

Wiki Article

About Custom Private Equity Asset Managers

You have actually probably become aware of the term private equity (PE): investing in companies that are not publicly traded. About $11. 7 trillion in properties were taken care of by personal markets in 2022. PE firms seek chances to make returns that are better than what can be accomplished in public equity markets. There may be a few things you don't understand about the market.

Personal equity firms have a variety of financial investment preferences.

Because the best gravitate towards the bigger bargains, the middle market is a substantially underserved market. There are a lot more vendors than there are very skilled and well-positioned financing experts with substantial purchaser networks and resources to take care of a bargain. The returns of personal equity are usually seen after a few years.

9 Easy Facts About Custom Private Equity Asset Managers Described

Traveling below the radar of big multinational corporations, a lot of these tiny firms commonly supply higher-quality client service a fantastic read and/or niche product or services that are not being provided by the large corporations (https://cpequityamtx.wordpress.com/). Such advantages draw in the interest of exclusive equity firms, as they have the insights and savvy to make use of such opportunities and take the firm to the next degree

Private equity capitalists need to have reputable, qualified, and trustworthy management in area. Many supervisors at profile companies are provided equity and bonus payment structures that reward them for hitting their monetary targets. Such alignment of objectives is commonly needed prior to a deal obtains done. Exclusive equity opportunities are usually out of reach for individuals that can't invest numerous bucks, however they should not be.

There are laws, such as restrictions on the accumulation quantity of money and on the number of non-accredited financiers (Private Equity Firm in Texas).

Examine This Report on Custom Private Equity Asset Managers

One more disadvantage is the absence of liquidity; once in an exclusive equity deal, it is hard to leave or offer. There is an absence of adaptability. Personal equity additionally includes high costs. With funds under administration currently in the trillions, personal equity companies have ended up being attractive financial investment vehicles for affluent people and organizations.

Now that access to exclusive equity is opening up to even more specific investors, the untapped capacity is ending up being a truth. We'll begin with the main arguments for spending in private equity: Exactly how and why private equity returns have actually traditionally been greater than various other assets on a number of degrees, Just how consisting of personal equity in a portfolio influences the risk-return account, by helping to diversify versus market and cyclical risk, After that, we will certainly describe some key considerations and threats for personal equity investors.

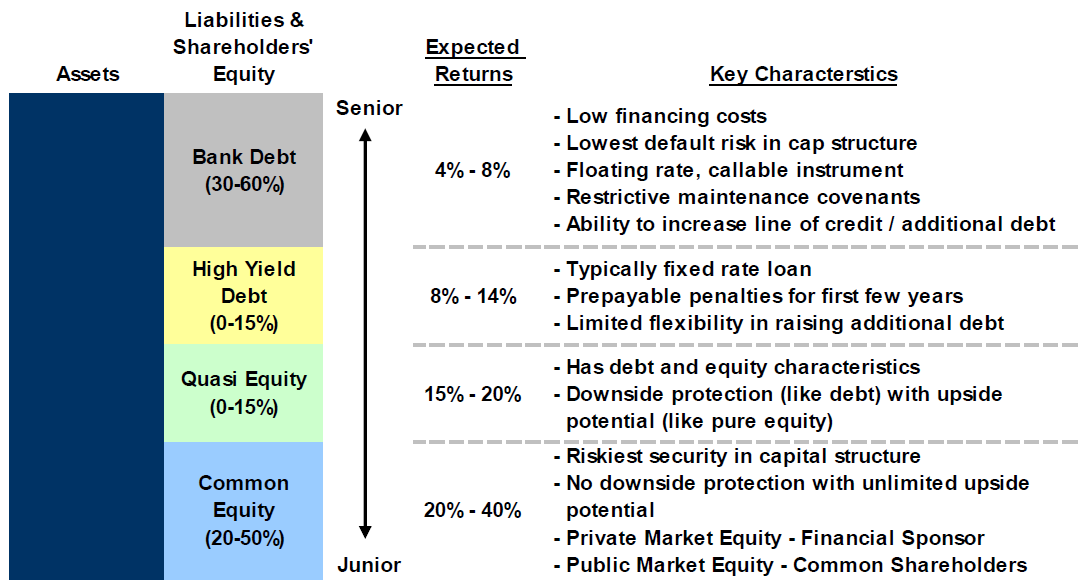

When it comes to presenting a new property into a portfolio, the a lot of standard consideration is the risk-return profile of that possession. Historically, personal equity has actually displayed returns similar to that of Arising Market Equities and higher than all various other conventional asset courses. Its relatively reduced volatility coupled with its high returns produces an engaging risk-return account.

Custom Private Equity Asset Managers - The Facts

In fact, exclusive equity fund quartiles have the best variety of returns throughout all different asset classes - as you can see listed below. Approach: Interior price of return (IRR) spreads out calculated for funds within classic years individually and after that averaged out. Average IRR was calculated bytaking the standard of the median IRR for funds within each vintage year.

The takeaway is that fund option is critical. At Moonfare, we accomplish a strict choice and due persistance procedure for all funds noted on the platform. The effect of adding personal equity right into a portfolio is - as constantly - depending on the portfolio itself. However, a Pantheon study from 2015 suggested that including exclusive equity in a portfolio of pure public equity can open 3.

On the other hand, the most effective private equity companies have accessibility to an also bigger pool of unknown opportunities that do not face the exact same scrutiny, as well as the sources to do due diligence on them and identify which are worth buying (Private Equity Platform Investment). Investing at the ground flooring indicates greater risk, yet for the business that do be successful, the fund advantages from greater returns

The Custom Private Equity Asset Managers Diaries

Both public and exclusive equity fund supervisors devote to spending a percent of the fund yet there continues to be a well-trodden concern with aligning interests for public equity fund management: the 'principal-agent trouble'. When an investor (the 'major') works with a public fund supervisor to take control of their resources (as an 'representative') they entrust control to the manager while preserving possession of the properties.

In the instance of personal equity, the General Partner does not just make an administration charge. They likewise earn a percentage of the fund's earnings in the type of "carry" (usually 20%). This ensures that the interests of the supervisor are lined up with those of the financiers. Private equity funds additionally alleviate one more form of principal-agent trouble.

A public equity investor inevitably wants something - for the administration to increase the supply price and/or pay dividends. The capitalist has little to no control over the decision. We revealed above just how numerous exclusive equity methods - especially bulk buyouts - take control of the operating of the company, making sure that the long-lasting worth of the business comes first, rising the roi over the life of the fund.

Report this wiki page